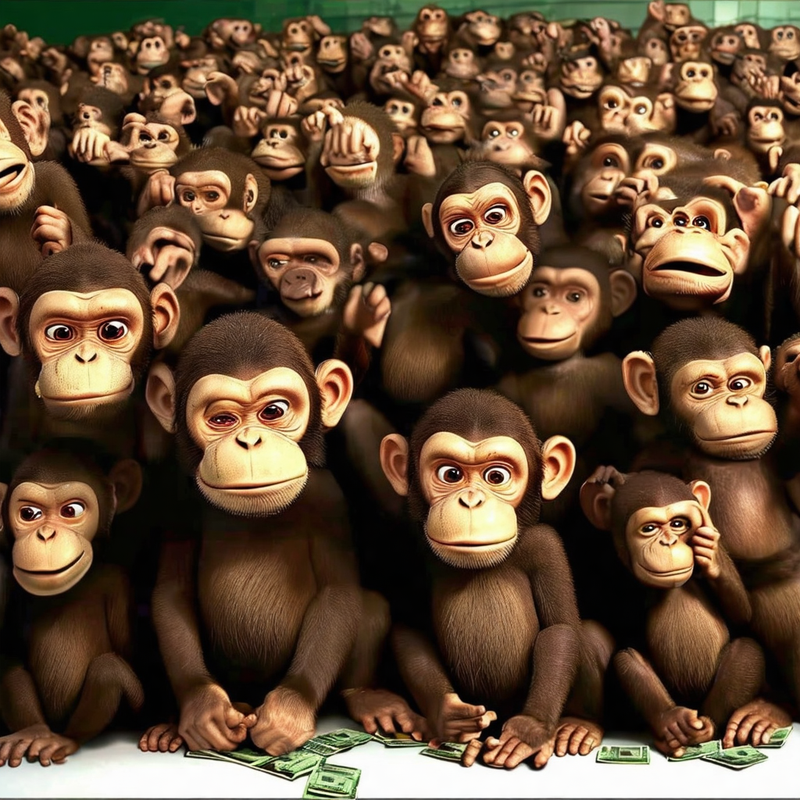

These blogs are notes to myself from the famous book ‘The Art of Thinking Clearly’ by Rolf Dobelli. Here, in this bias, he explains it using an example of monkeys speculating in the stock market. In the hypothesis, we start with 1 million monkeys and keep on removing half of the monkeys in each iteration. Since in each iteration we keep on removing loss-making monkeys, we are left with just one monkey in the end. This monkey is a billionaire, a success monkey.

The whole media, newspapers, vloggers are behind this monkey; they are recording every act of the monkey—how it sits, how many bananas it eats, which games it plays, etc. He must have some recipe for success, right?

This story illustrates the outcome bias.

It is also known as historian error because, in retrospect, every signal looks so clear, while in the present we tend to make decisions on the basis of information available at the current time.

In the below Reddit post, someone has beautifully explained an example of outcome bias in day trading.

Dealing with the Outcome Bias in Trading: A point of view

byu/hoc-trade inDaytrading

Conclusion

Never judge a decision purely by its result

We should keep this in mind when we try to change our decisions by seeing others. External factors should be considered too.

A bad result doesn’t automatically indicate a bad decision and vice versa.

Don’t regret a wrong decision or applaud yourself over a coincidental success, remember what you chose and what you did. Were your reasons rational and understandable? If yes, then you would do well to stick with that method, even if you didn’t strike lucky last time.